Financial aid is money provided to a student in order to pay for college expenses. There are several types of financial aid, and most students are eligible to receive at least some form of financial aid.

Use this page to understand how your financial aid is processed. Check your financial aid status by going to MyU: My Finances. Depending on the aid offered to you, you may not need to complete all the steps below.

Steps to receive financial aid

Step 1: Apply for financial aid

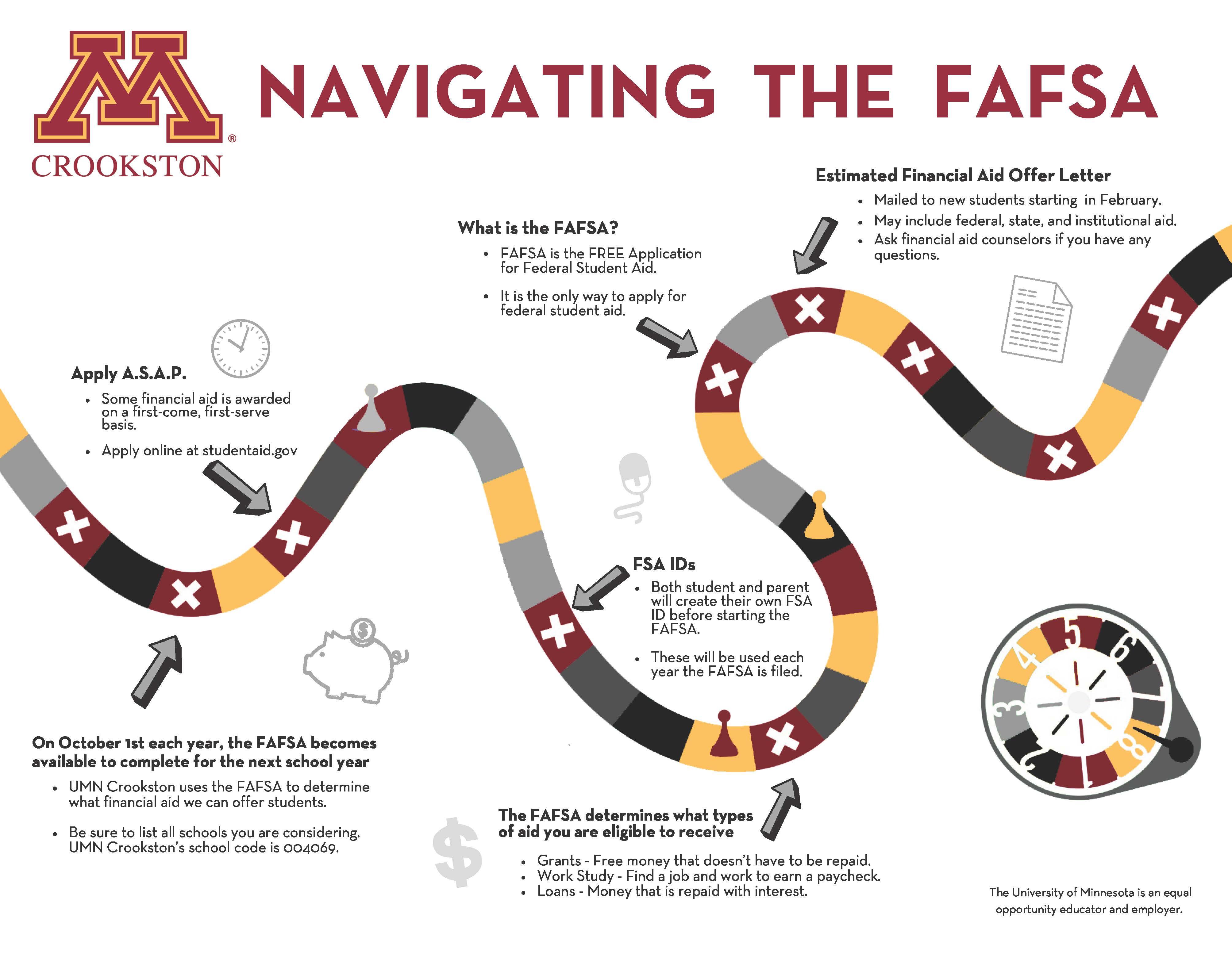

Complete a Free Application for Federal Student Aid (FAFSA). The FAFSA is used for all types of financial aid, including federal and state aid.

The FAFSA application becomes available on October 1 and closes on June 30.

- The 2022-2023 FAFSA is available from October 1, 2021 to June 30, 2023. Use your 2020 income tax return.

- The 2023-2024 FAFSA will be available from October 1, 2022 to June 30, 2024. Use your 2021 income tax return.

It is in your best interest to file the FAFSA on, or as soon as possible after, October 1 in order to meet FAFSA deadlines. Some financial aid programs have limited funding and deadline requirements. Once you have filed your FAFSA, check your FAFSA status in MyU: My Finances.

- Priority deadline for incoming freshmen: March 15

- Priority deadline for returning students: March 1

Resources

School code

When you fill out the FAFSA, the application will require you to enter the school code. Each University of Minnesota campus has its own federal school code. For Crookston students, the school code is 004069.

Step 2: Complete additional documentation - To Do List

After we receive your Free Application for Federal Student Aid (FAFSA), you may receive a request for additional documentation by mail or email to complete your application. Your to do list will also show required loan documents if you request to borrow these funds. You can monitor your progress in MyU: My Finances.

View your to do list

Text instructions

- Log into MyU and select the My Finances tab.

- Click the Financial Aid sub-tab.

- Select the Aid Year and Campus in the Financial Aid Steps section. An aid year begins with the fall term.

- View your Financial Aid Steps.

- Click the “There are items you must complete” link in Step 2.

- View your To Do List. Click on the item(s) listed for details. This may include printing and submitting documentation.

Visual guide

To open the guide in a new window, use the full-screen version.

Step 3: Respond to your financial aid offer

You will receive an email notification with a link to view and respond to your financial aid offer online. Follow the instructions in the email to:

- View financial aid

- Accept/decline financial aid (if applicable)

- Report any other financial aid (e.g. outside scholarships)

Please note, your financial aid offer is based on full-time attendance for one academic year (fall and spring semesters). The total aid is divided equally between semesters; one-half for fall expenses and one-half for spring expenses. The amount of your aid is based on your financial need, which is determined by:

- A federal process that calculates your expected family contribution (EFC), based on the Free Application for Federal Student Aid (FAFSA) result, and

- An assumption that you will be enrolled full-time.

If you do not receive notification that your financial aid offer is available, check MyU: My Finances.

View and respond to your financial aid awards

Text instructions

- Log into MyU and select the My Finances tab.

- Click the Financial Aid sub-tab.

- Select the Aid Year and Campus in the Financial Aid Steps section. An aid year begins with the fall term.

- Steps will appear after selecting the Aid Year and Campus.

- Click the link in Step 3 (the link says view or respond). If you don’t see this link, financial aid has not yet been awarded.

- Click the Aid Year link.

- View your financial aid that is displayed for the full year followed by the breakdown for each term.

- To respond to your financial aid, click the Accept/Decline Awards link.

- Check the boxes to Accept or Decline any loans or work-study. Gift aid is automatically accepted.

- If you click accept, you will have the option to enter a specific amount. You do not need to accept the full amount.

- When you are finished accepting or declining your aid, click the Submit button to confirm your choices.

Visual guide

To open the guide in a new window, use the full-screen version.

Step 4: Complete loan documents

If you choose to accept loans, check your status in MyU: My Finances to complete all required documentation. If you accepted a federal loan(s) you will need to complete all required promissory notes, counseling, and disclosures before the loans can be disbursed. A promissory note is the legal agreement that you will repay your loan(s).

If your parent(s) wants to borrow a PLUS loan, they will need to complete the PLUS loan application on the Federal Student Aid website and the PLUS Master Promissory Note before the funds will disburse to your student account.

If you are applying for a private loan, you will need to complete all necessary documents required by the lender you have chosen.

Step 5: Receive your financial aid disbursement

If all prior steps are complete, you should receive your financial aid disbursement to your student account approximately one week prior to the start of the semester. When this happens, you will be sent an email to your University account indicating that your financial aid has been disbursed. The University disburses financial aid prior to the start of the term to ensure you are able to purchase necessary textbooks and supplies. Required books and supplies can be charged to your student account at the University bookstore.

If your financial aid exceeds the university charges, you will have a credit balance on your student account. Sign up for direct deposit to receive your credit balance electronically to your bank account. If your financial aid does not cover the balance on your student account you will receive a billing notice via email.

If you complete the financial aid process after the start of the semester, you will receive your funds in approximately seven business days.

Additional funding options

Your financial aid offer may not cover your entire estimated cost of attendance. There may be additional funding options available to you or your parents that were not included in your offer. If you need additional funding, you are encouraged to investigate the options below.